On the same day that journalist Matt Taibbi was scheduled to testify before a House committee investigating the weaponization of the government, he received a visit from the IRS.

The Wall Street Journal wrote an editorial discussing what happened: “Democrats are denouncing the House GOP investigation into the weaponization of government, but maybe that’s because Republicans are getting somewhere. That includes new evidence that the Internal Revenue Service may be targeting a journalist who testified before the weaponization committee.

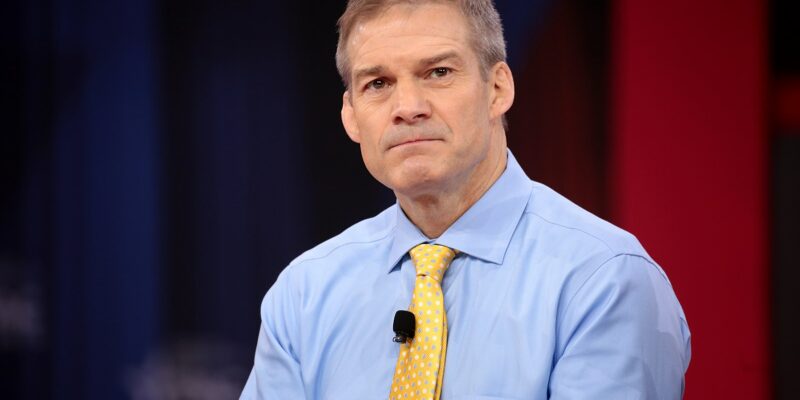

House Judiciary Chairman Jim Jordan sent a letter Monday to IRS Commissioner Daniel Werfel and Treasury Secretary Janet Yellen seeking an explanation for why journalist Matt Taibbi received an unannounced home visit from an IRS agent. We’ve seen the letter, and both the circumstances and timing of the IRS focus on this journalist raise serious questions.

Mr. Taibbi has provoked the ire of Democrats and other journalists for his role in researching Twitter records and then releasing internal communications from the social-media giant that expose its censorship and its contacts with government officials. This effort has already inspired government bullying, with Chair Lina Khan’s Federal Trade Commission targeting new Twitter owner Elon Musk and demanding the company “identify all journalists” granted access to the Twitter files.

Now Mr. Taibbi has told Mr. Jordan’s committee that an IRS agent showed up at his personal residence in New Jersey on March 9. That happens to be the same day Mr. Taibbi testified before the Select Subcommittee on the Weaponization of the Federal Government about what he learned about Twitter. The taxman left a note instructing Mr. Taibbi to call the IRS four days later. Mr. Taibbi was told in a call with the agent that both his 2018 and 2021 tax returns had been rejected owing to concerns over identity theft.”

The New York Post said that “Taibbi gave the committee documents that indicate his 2018 return had been electronically accepted and the IRS never told him or his accountants there was an issue with it over the last 4¹/₂ years, according to the Journal.

His 2021 return was at first rejected, and then rejected again after he refiled, despite his accountants refiling with an IRS-provided PIN number, he said.

Taibbi said in neither case was it a money issue, and that the IRS actually owed him a ‘considerable’ sum.

The WSJ editorial asks the pertinent question: “when did the IRS start to dispatch agents for surprise house calls? Typically when the IRS challenges some part of a tax return, it sends a dunning letter. Or it might seek more information from the taxpayer or tax preparer. If the IRS wants to audit a return, it schedules a meeting at the agent’s office. It doesn’t drop by unannounced.”

Such a visit is at odds with what the Treasury Secretary Janet Yellen recently told Congress when she said that one of the reasons the IRS is so unpopular is because there are too few agents.

Biden Treasury Secretary Janet Yellen: Public opinion of the IRS is "extremely negative" because the IRS isn't large enough pic.twitter.com/PqJljREkcA

— RNC Research (@RNCResearch) March 24, 2023

The Democrats have been criticized for doubling the size of the IRS in their signature legislative accomplishment. They claim that the new agents won’t be used to harass those whom they disagree with and only go after the “super rich,” but studies have shown this will not be the case.

Most recently, the IRS announced that it will be investigating tips received by waiters and waitresses.

While speaking to a congressional committee asking about the IRS’s request for an additional $29 billion, “Yellen said she would unveil ‘in the coming weeks’ a promised spending plan for the $80 billion in IRS investments approved last year as part of the climate and healthcare-focused Inflation Reduction Act, according to Reuters.

“The additional $29.1 billion in long-term enforcement investments would add two more years to the $80 billion program for 2032 and 2033, according to the budget. The Treasury estimates that this would produce an additional $105 billion in net revenue from collections during those two years.”

“A longtime reporter for Rolling Stone, Taibbi has been one of the leading figures in the Twitter Files saga since Elon Musk bought the social media platform. Making good on his promises to increase transparency at Twitter, Musk has been giving internal documents and other evidence to several journalists, including Taibbi, for the purpose of exposing political bias, censorship, and other forms of corruption under the previous Twitter leadership. Taibbi and others would post the evidence in extensive threads on the platform, noted American Greatness.“

Taibbi has since refused to comment publicly on the incident, deferring to Jordan’s letter and any possible response from the IRS.

“For those asking, I don’t want to comment on the IRS issue pending an answer to chairman @Jim_Jordan’s letter,” Taibbi posted on Twitter. “I’m not worried for myself, but I did feel the Committee should be aware of the situation.”

Taibbi, and other journalists involved in the posting of the Twitter Files such as Michael Shellenberger, have faced criticism from Democrats for what they call cherry-picked examples of bias at Twitter; Democrats have claimed, without evidence, that the proof shown in the Twitter Files is selective and does not paint the full picture. In response to mockery from Virgin Islands Delegate Stacey Plaskett, Taibbi said “I am not a ‘so-called’ journalist.”

Last week, Biden was accused of trying to censor stories that he did not like, both within the media and on social media.

[Read More: ‘Marxist’ Professor Says Killing Conservatives Is ‘Admirable’]