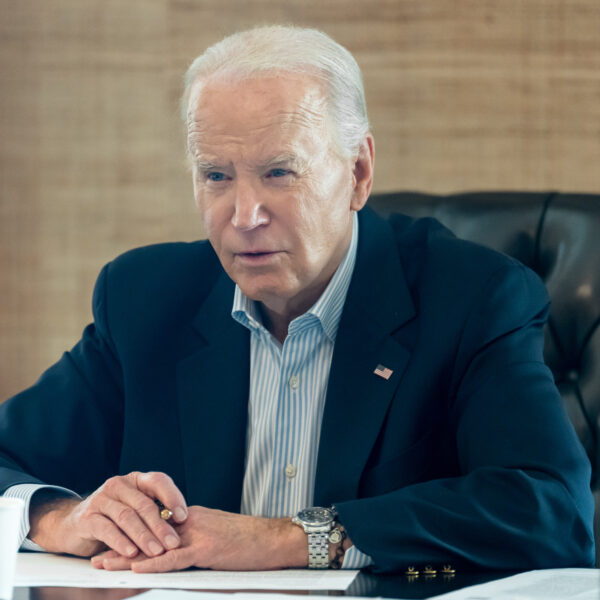

Last night during the State of the Union, President Biden claimed to be a working-class leader but threatened to veto any bill that would repeal his extreme expansion of the Internal Revenue Service. Over the summer, the Democrats permitted the tax collectors to add 86,852 more agents to its ranks and added tens of billions to its budget.

At the time of passage, Democrats promised that there would be no auditing of regular Americans. The New York Times noted that “Charles P. Rettig, the Internal Revenue Service commissioner, told Congress on Thursday that the tax collection agency would not increase audits of households earning less than $400,000 if it was given the additional $80 billion,” but most people aren’t buying it.

Republicans have already tried to roll back the expansion, but the Democrats are full steam ahead.

🚨 House Republicans just voted unanimously to repeal the Democrats' army of 87,000 IRS agents 🚨

This was our very first act of the new Congress, because government should work for you, not against you.

Promises made. Promises kept.

— Kevin McCarthy (@SpeakerMcCarthy) January 10, 2023

Now we are finding out who Democrats believe are “rich,” and it includes waiters and waitresses.

Fox News reports that the IRS is now planning to come after tips. “The Service Industry Tip Compliance Agreement (SITCA) program would be a voluntary tip reporting system in which the IRS and service industry companies cooperate, according to the announcement Monday. As part of the proposal, the IRS will give the public until early May to provide feedback on the program before implementing it.

“Those 87,000 new IRS agents that you were promised would only target the rich,” tweeted Mike Palicz, federal affairs manager at Americans for Tax Reform. “They’re coming after waitresses’ tips now.”

Among the program’s features, the agency lists “monitoring of employer compliance based on actual annual tip revenue and charge tip data from an employer’s point-of-sale system, and allowance for adjustments in tipping practices from year to year.”

It also states that participating employers would provide the IRS with annual reports, would receive protection from liability related to “rules that define tips as part of an employee’s pay” and would have the flexibility to implant internal tip reporting procedures “in accordance with the section of the tax law that requires employees to report tips to their employers.”

Stop the presses. No need to raise the debt limit. Biden is going after those billionaire waitresses’ tips.

HT: Mike @taxreformer pic.twitter.com/DRIHtPoIDM

— Thomas Massie (@RepThomasMassie) February 8, 2023

What restaurants is Joe Biden going to where service staff is making more than $400,000 a year? Surely the Democrats didn’t lie when they said that a huge expansion of the IRS wouldn’t impact working people.

They, of course, did. Shaking down waiters and waitresses is likely only the beginning.

Reason discussed last month a study out of Syracuse University’s Transactional Records Access Clearinghouse (TRAC) released data provided to it by the Internal Revenue Service (IRS) on audits performed by the agency in fiscal year 2022. Despite the infusion of new funding earmarked for the IRS via last year’s Inflation Reduction Act, the agency continued historic trends of hassling primarily low-income taxpayers, with relatively few millionaires and billionaires getting caught up in the audit sweep.

“The taxpayer class with unbelievably high audit rates—five and a half times virtually everyone else—were low-income wage-earners taking the earned income tax credit,” reported TRAC, noting that the poorest taxpayers are “easy marks in an era when IRS increasingly relies upon correspondence audits yet doesn’t have the resources to assist taxpayers or answer their questions.”

In fact, “if one ignores the fiction of auditing a millionaire through simply sending a letter through the mail, the odds that millionaires received a regular audit by a revenue agent (1.1%) was actually less than the audit rate of the targeted lowest income wage-earners whose audit rate was 1.27 percent!”

There’s a reason why Democrats balked when Republicans tried to put in protections for middle-class and poor Americans, blocking amendments to outwardly state “no language protecting middle-class taxpayers from the new barrage of IRS audits.”

Those who want to provide feedback and public comment on the matter must do so by May 7, according to Fox Business.

Many service industry workers, like those in restaurants, work below minimum wage and depend on tips as an important portion of their pay, but it looks like they will be joining the ranks of those targeted by the IRS.

They won’t be alone, though. The agency has also proposed rules on reporting payments over $600 received via Venmo and PayPal. After all, those 80,000 IRS agents can’t all go after Bill Gates and Elon Musk.

[Read More: Don Lemon Makes Co-Host Cry, Leave Set]