Bidenomics has finally gone into full effect, and it turns out that you need to do more to fight inflation than pass a massive spending bill called “The Inflation Reduction Act.”

Pie-in-the-sky liberal economics has once again been mugged by reality.

Stocks dropped sharply on Wednesday after March inflation data showed that the prices Americans pay for everyday goods increased much higher than anticipated. The news likely means that the Federal Reserve will likely delay interest rate cuts that investors have been hoping for.

CNBC reported that “investor sentiment was further dampened following the release of March’s Fed meeting minutes, which reflected officials’ concerns that inflation isn’t moving quickly enough toward the central bank’s 2% target.

The Dow Jones Industrial Average dropped 422.16 points, or 1.09%, to end at 38,461.51. The S&P 500 slid 0.95% to 5,160.64. Nasdaq Composite tumbled 0.84% to close at 16,170.36.

With the exception of energy, all sectors in the broad market index were negative on the session. Real estate fell 4.1%, leading sector losses for the day. The S&P 500 had been treading water in April in anticipation of this inflation report following a roaring start to the year in which the benchmark rallied more than 10%, its best first-quarter gain in five years.

The CPI in March rose 0.4% for the month and 3.5% year over year, versus estimates for a 0.3% monthly increase and 3.4% from 12 months earlier, according to economists polled by Dow Jones. Core CPI, which excludes volatile food and energy prices, accelerated 0.4% from the previous month while rising 3.8% from a year ago, compared to estimates for 0.3% and 3.7%, respectively.”

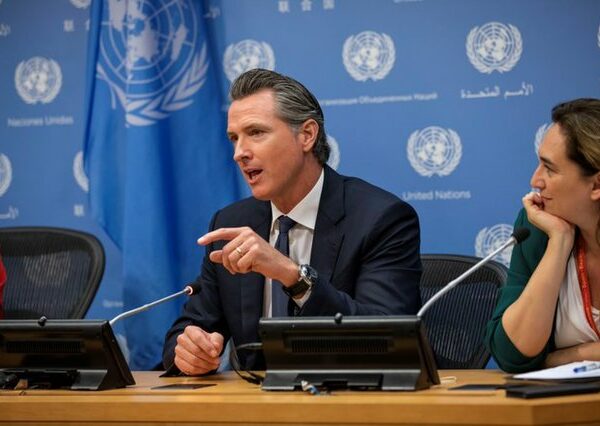

During a press conference with the Japanese prime minister, the president defended his economic plan despite the news.

“I do stand by my prediction that before the year is out, there will be a rate cut,” Mr. Biden said at a news conference alongside Prime Minister Kishida Fumio of Japan, after the two of them met at the White House.

“This may delay it a month or so — I’m not sure of that,” Mr. Biden said. “We don’t know what the Fed is going to do for certain. But look, we have dramatically reduced inflation.”

The New York Times noted that in his desperation “Mr. Biden’s comments dipped a toe into what has historically — with notable exceptions — been a taboo subject for presidents: weighing in on Fed policy. Many of Mr. Biden’s predecessors have refrained from even speculating about interest-rate decisions, citing the Fed’s independence. The president’s immediate predecessor and now re-election opponent, Donald J. Trump, broke from that history, by frequently and loudly criticizing the Fed when he was president and demanding the central bank to reduce interest rates.”

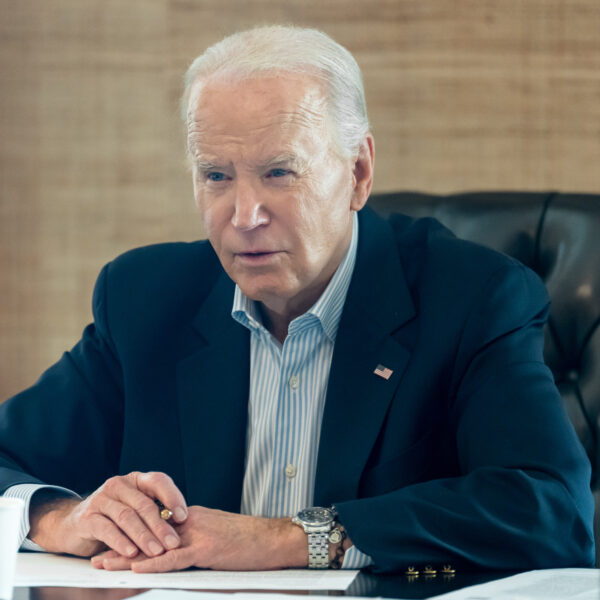

Biden understands, or at least the ones handing him his notecards to read for his pre-planned questions do, that inflation and higher interest rates have made it difficult for ordinary Americans to buy a home.

No one in the media cares that every public Biden interaction is entirely scripted because supporting their political party comes first https://t.co/05J8URnjev

— Ian Miller (@ianmSC) April 10, 2024

Realtor Magazine reported that “the latest inflation data could push mortgage rates higher, economists are saying. Consumer prices reaccelerated in March, showing a more somber picture of economic progress and throwing into question the Federal Reserve’s planned rate cuts this year. Housing analysts had been hoping that such cuts could help bring mortgage rates lower.

“March inflation figures were very bad, which also means bad news for interest rates,” says Lawrence Yun, chief economist at the National Association of REALTORS®.

‘Mortgage rates, unfortunately, will move a notch higher and are likely to cross above 7% in the upcoming weeks,’ Yun says. ‘In addition, the gigantic federal budget deficit will soak up more borrowing, thereby leaving less for mortgage borrowing.’

Yun notes that the latest measure of ‘shelter’ inflation, which has been climbing monthly, is 5.7% higher than a year ago.”

The Washington Examiner detailed how Bidenomics has failed, especially for Americans looking for full-time jobs, let alone those hoping to launch a career and take care of their families.

The headline numbers of 300,000 jobs created and an unemployment rate under 4% look solid. But the growth is in part-time jobs. There are more full-time jobs but only in nonproductive sectors, such as government and government-subsidized healthcare.

Bidenomics seems only to be working for part-time, mostly foreign workers. The rest of the population is out of luck as prices rise and borrowing costs make American dream essentials, such as a house and a car, less affordable than ever.

Twelve months ago, 134,287,000 Americans had full-time jobs. Today, that number has fallen to 132,940,000. For all Biden’s talk, there are a million fewer people with full-time jobs now than there were a year ago. By contrast, some 26,744,000 people had part-time jobs a year ago, but that number has risen to 28,632,000 now. The number of people reporting they work more than one job has also risen by almost half a million in the past year.

The sectors where jobs are being created should also alarm anyone interested in the long-term strength of the economy. Ideally, we’d be creating jobs in productive sectors, such as manufacturing and software. But that is not happening. The fastest-growing sector under Biden has been healthcare, which is largely financed by government spending through Medicare, Medicaid, and insurance subsidies, while the second-fastest-growing sector has been government jobs. No country ever grew strong on government and healthcare jobs. Manufacturing employment is flat, and the information sector actually lost jobs.

Biden’s obsession with spending and “green energy,” along with his desperate move to hand out billions of dollars to well-to-do college students in the name of canceling student loans, has only made the lives of most Americans worse.

One report has said that Biden’s regulations alone will increase the price Americans have to pay for things by nearly $1 trillion.

Undecided voters hailing from battleground states chuckled at the notion of President Biden’s economic strategies outpacing those of former President Trump in a recent focus group footage, according to Fox News.

“On Wednesday, the video platform 2WAY released the first installment of its new project “The Undecideds.” The first episode featured a focus group of eight undecided voters from Michigan, Pennsylvania and Wisconsin who discussed their thoughts on the state of the economy, which they considered to be their “single biggest reservation” about voting for Biden.

Mark Halperin is one of founding members of the 2WAY platform, who conducted the focus group and helped design “The Undecideds” project. He told Fox News Digital, “‘The Undecideds’ is an unprecedented 2024 battleground state project that will bring together the most critical voters in the country, drawn exclusively from the seven states that will pick the next American president.”

‘Through a unique combination of synchronized polling and focus groups, viewers will meet, learn about, and hear from fellow citizens in Michigan, Wisconsin, Pennsylvania, North Carolina, Georgia, Nevada, and Arizona, and watch as they grapple with indecision about whom to support for president – or whether to vote at all,’ Halperin added.

‘I think he’s been absolutely disastrous for the economy,’ Nathan, a Wisconsin voter, said.

Others could be seen nodding in agreement. Pennsylvania voter Virginia remarked, ‘I agree.'”

Many of the participants cited their 401K, high interest rates caused by Biden’s spending, and the price of housing as their main economic concerns.

[Read More: Border Crisis Finally Gets To Biden Administration]