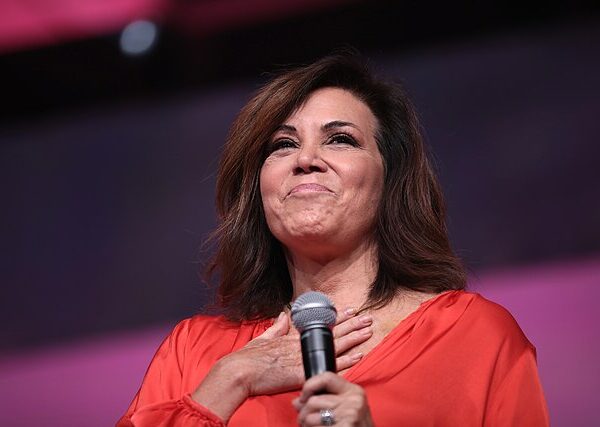

Florida Republican Rep. Anna Paulina Luna’s push to force a House vote on banning lawmakers and their families from trading individual stocks has entered a new and unexpectedly combative phase, with Luna now accusing Democratic leadership of actively pressuring members not to sign.

It appears that the apple doesn’t fall too far from the tree when it comes to Hakeem Jeffries and Nancy Pelosi.

In a Fox News clip aired Tuesday night, host Jesse Watters played comments from Luna alleging that House Minority Leader Hakeem Jeffries has personally instructed Democrats to avoid supporting the discharge petition. “We have Democrats that want to sign it, but leadership is telling them no,” Luna told Watters, asserting that internal pressure — not ideological disagreement — is slowing what has long been billed as a broadly bipartisan reform.

🚨BREAKING: Rep Anna Paulina Luna says Hakeem Jeffries is BLOCKING a STOCK-TRADING BAN in CONGRESS 🚨@RepLuna: “I am CALLING ON Hakeem to PUT IT ON THE FLOOR” pic.twitter.com/3bExyO6AU9

— Jesse Watters (@JesseBWatters) December 9, 2025

The petition, filed December 2, seeks to force H.R. 1908 — the End Congressional Stock Trading Act sponsored by Rep. Tim Burchett of Tennessee — directly to the floor, bypassing Speaker Mike Johnson and House committee bottlenecks. That procedural tool, historically used sparingly, allows any member to circumvent leadership if they secure signatures from a simple majority of the chamber.

The underlying legislation is hardly new and has accumulated wide rhetorical support. A separate bipartisan bill introduced in September by Rep. Chip Roy of Texas, co-sponsored by Luna and Burchett, has more than 100 backers, yet remains locked in committee despite repeated calls for expedited action. Reformers argue that public sentiment is beyond dispute and that congressional inaction has eroded trust. “Across the country, from every political background, the American people agree on one thing: Members of Congress should not be enriching themselves with insider knowledge,” Luna said in announcing the petition, framing the ban as a prerequisite to “restoring trust in the institution.”

Current law requires members to disclose securities transactions above $1,000 within strict timelines, but imposes no outright ban on individual trades. Polling shows overwhelming support — often above 85 percent — for stronger restrictions, particularly after a series of scandals over trades tied to confidential COVID-19 briefings in early 2020. Reform advocates describe disclosure requirements as insufficient guardrails in an environment where lawmakers routinely receive market-moving information.

Despite broad interest in reform, the discharge petition has been slow to gain public signatures. As of Tuesday evening, only Luna and Burchett were listed on the House clerk’s website, though several Republicans — including Rep. Lauren Boebert — have posted on social media saying they intend to sign. The lag has fueled speculation that leadership in both parties prefers to resolve the matter privately rather than cede procedural leverage to rank-and-file members.

Speaker Johnson, asked last week about Luna’s maneuver, urged patience and suggested the House continues to work toward consensus legislation. He noted that he had not reviewed the petition and emphasized the shared objective of preventing insider dealing while maintaining the ability of public officials to “still own equities” without discouraging qualified candidates from entering government. He has previously promised to bring a ban on stock trading to the floor.

Democratic leadership has not publicly commented on Luna’s allegation that members are being told not to sign — a silence that has intensified questions about how far either party is willing to go to relinquish personal financial flexibility.

Securing 218 signatures remains an uphill battle. Discharge petitions — a procedural relic often used only when leadership refuses to move a bill — rarely succeed. Only about 4 percent have worked since the process was created in 1935, according to the Brookings Institution. But Luna has already demonstrated that persistence can matter: earlier this year she helped marshal a successful petition securing proxy voting rules for new parents, and another bipartisan petition forced the release of government files related to Jeffrey Epstein.

The political climate has shifted as former lawmakers, watchdog groups, and ethics advocates elevate pressure. Ninety former members of Congress sent a letter last week urging leadership to adopt stock-trading reform before adjournment, warning that further delay would reinforce public cynicism about political self-dealing.

Momentum in the Senate has been similarly uneven. A companion bill led by Missouri Republican Sen. Josh Hawley advanced out of committee over the summer but has not progressed since. Reformers argue that any final agreement requires bicameral alignment, a hurdle that continues to stall movement even as the end of the 119th Congress approaches.

For Luna, the stalemate has grown intolerable. She told Watters the procedural delays and behind-the-scenes resistance have dragged on for months: “I’m not waiting any longer.”

[Read More: 2028 Hopeful Helped Thousands Of Criminals Get Back On The Street]